Home Sellers: There Is an Extra Way To Welcome Home Our Veterans

Some veterans are finding it difficult to obtain a home in today’s market. According to the National Association of Realtors (NAR):

“Conventional conforming mortgages (mortgages that conform to guidelines set by Fannie Mae and Freddie Mac), accounted for 74% of mortgages obtained by homebuyers in May 2021. That is an increase from about 65% during 2018 through 2019…The share of Veterans VA-guaranteed loans has also decreased to 7% in May 2021 from about 10% in past years.”

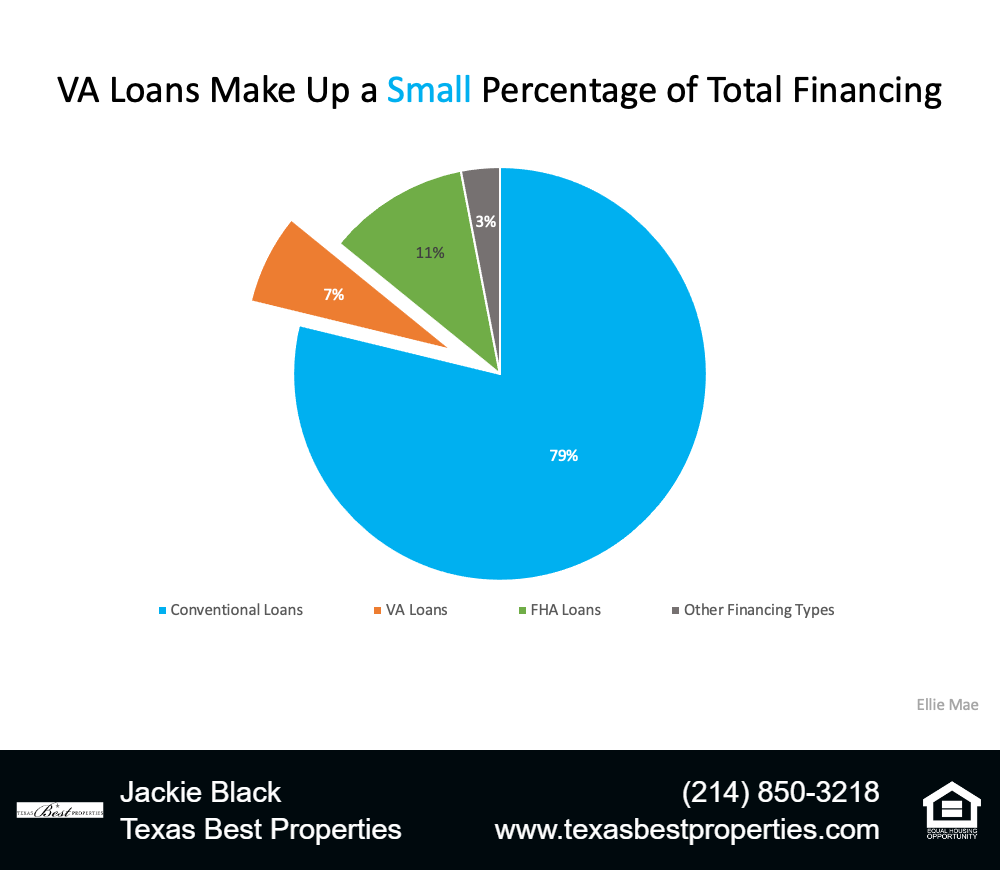

Recent data in the latest Origination Insight Report from Ellie Mae sheds light on the continuation of this trend. Below, we can see just how small of a share of total financing VA loans made up in June of 2021, according to that Ellie Mae report:

Veterans continue to face difficulties when it comes to buying a home and that can be attributed to the the stigma of VA Loans. The NAR article elaborates:

“It is extremely difficult for FHA/VA buyers to get accepted in a multiple offer situation. They are on the bottom of the hierarchy.”

One contributing factor is that buyers with VA loans can’t waive certain contingencies. However, just because a certain contingency must be present for a particular buyer doesn’t mean that buyer’s offer shouldn’t be considered.

What Should Sellers Do To Help Create a Level Playing Field?

As a seller, it’s important to consider every offer in front of you regardless of loan type. An offer with some contingencies are waived, doesn’t always mean the offer is what’s best for you.

Buyers who can’t waive specific contingencies may adjust other terms in their offer to make it more appealing to sellers. This may depend on several factors, including their loan type and location, but a motivated buyer and their agent will do everything they can to present an offer that’s as appealing to you as possible.

Ultimately, you should make sure you take time to really understand the terms of their offer and see the big picture. Work with a driven buyer who’s motivated to purchase your house and that may provide a better opportunity for you to reach your overall best option and what’s most important to you.

Bottom Line

If you’re ready to sell, let’s connect. Together, we can make sure you understand the terms of all offers so you can give each one fair consideration, including those buyers using a VA loan. Our veterans sacrifice so much for our country. They’ve earned our gratitude and should have the same opportunity to obtain the home of their dreams.

Our partner, First Financial Bank and Kami Graves can work with VA for Veterans to help you decide what options are best for you. Click Here for their information.

Click Here for Sellers’s Guide

Call me for more information:

Jackie Black, Owner/Broker

Texas Best Properties

8849 Davis Blvd., Suite 500

Keller, Texas 76248

214-850-3218

Email me!

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Jackie Black & Associates, LLC, dba Texas Best Properties, nor Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. Conduct your own research and due diligence and obtain professional advice before making any investment decision. Jackie Black & Associates, LLC, dba Texas Best Properties nor Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.